THE ADVANTAGES

North-South link

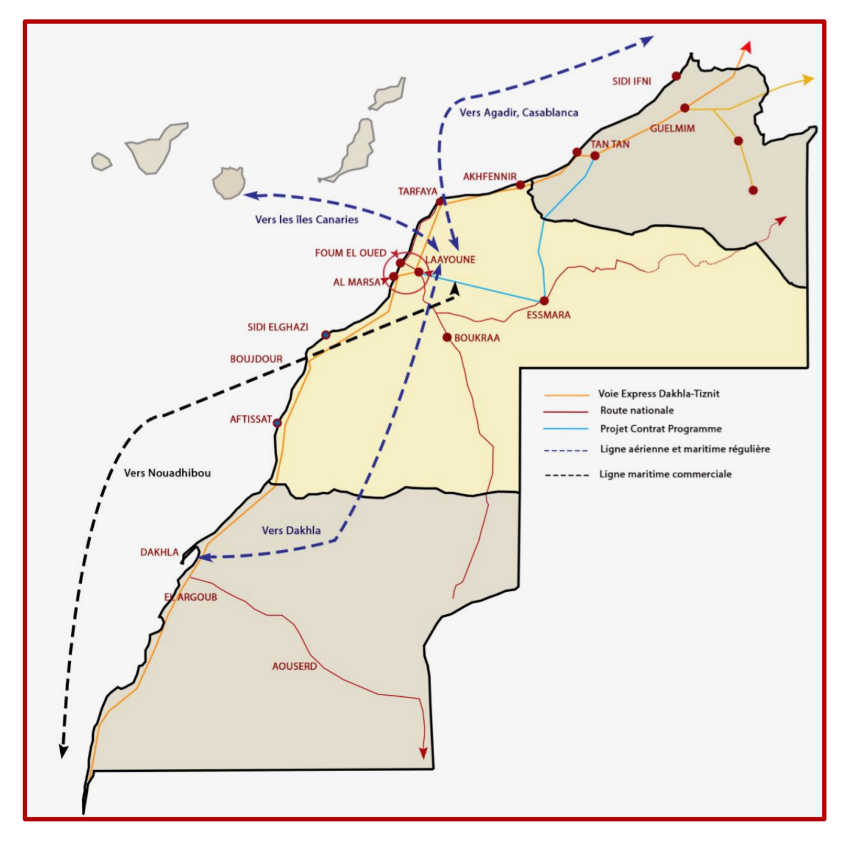

The region’s advantageous geographic location and strong connectivity to the road network, particularly the Tiznit-Dakhla expressway towards African countries, make it an ideal future African hub. With its port infrastructure, including the region’s own ports and the upcoming Dakhla Atlantic Port, the region has a competitive edge in international trade and serves as a link between the North and the South.

Furthermore, the LSH Region’s strategic position in air transport offers an opportunity for it to become an important air hub that serves sub-Saharan African countries as well as Europe, including the Canary Islands, which are only a 30-minute flight away and have a large tourism market. Access to the Canary Islands can also be facilitated through the Tarfaya-Canary Islands maritime connection, which is currently being resumed.

Multiple International Standard Infrastructures

Significant transport and logistics infrastructures

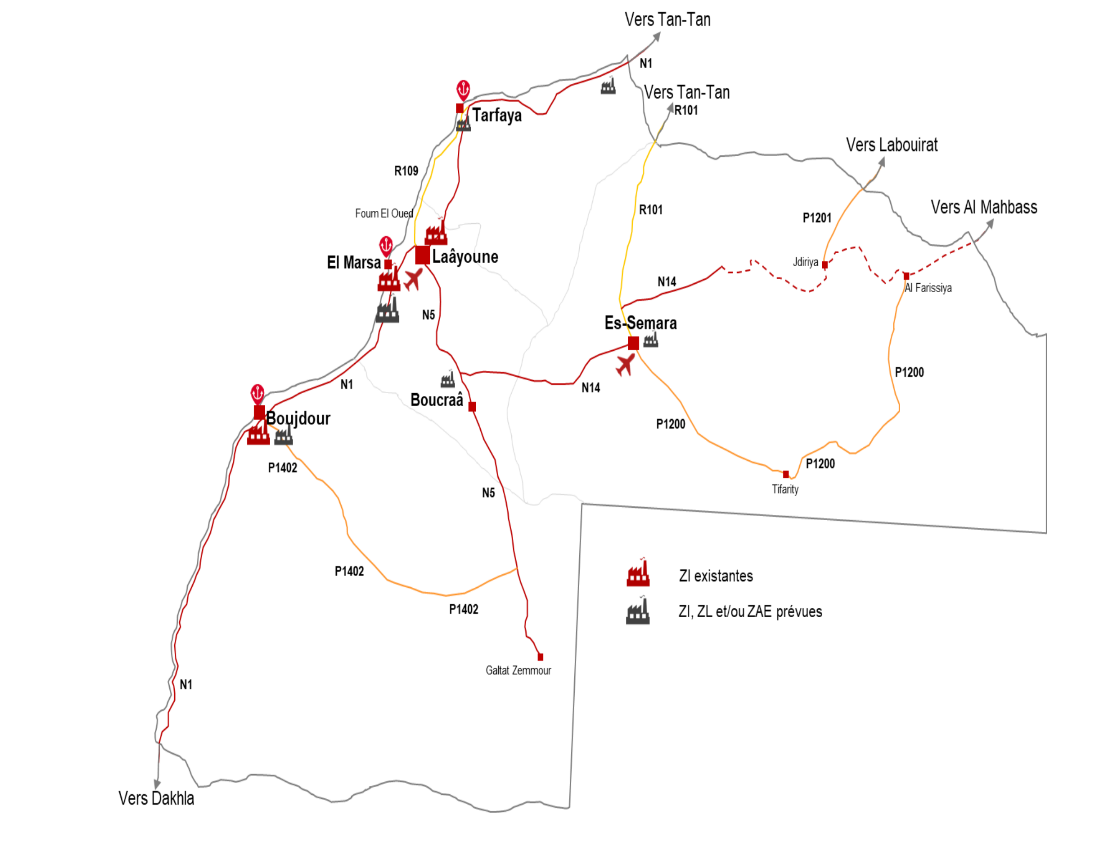

The network of transport infrastructure across the RLSAH is quite developed and diversified, with ports, airports, and a road network that meet international standards. In addition, a 1,055 km expressway linking Tiznit to Dakhla via Laayoune, included in the 2015-2021 program contract, is in the final stages of completion. It will strengthen economic exchanges between the northern part of the Kingdom and its African hinterland.

Developed telecommunications infrastructure

Telecommunications infrastructure in the region has seen significant development in recent years, thanks to the significant investment efforts made by national operators in the region, which have improved and modernized telecommunications networks and supported regional economic growth. The region has more than 27 post offices (according to Barid Al Maghrib) and a vast network of transmission via air links, contractors, or proprietary means. In addition, the region is covered by the mobile phone network of the three national operators, with fiber optic infrastructure.

Offer of Next-Generation Training

Several infrastructure projects for training, as part of the 2015-2021 program agreement, are currently completed and open to students: the university center, vocational training institutes, the City of Trades and Skills, and the medical school. All of these institutions will meet the region’s specific needs for skills, in perfect harmony with the new growth drivers of the region.

Abundant natural resources

Fisheries resources

The Atlantic coasts of the Region, spanning 575 km, are very rich in fisheries resources and represent 30% of the national catch. The valorization of fish products is done through preservation, freezing, or production of fishmeal and fish oil. In addition, the Region enjoys a natural ecosystem favorable to the development of aquaculture activities.

Mining resources

The region is home to important and diversified mining deposits. However, the main mining activity that currently creates wealth and employment at the local level focuses on the extraction of phosphates, for which a valorization project is being carried out to produce derived fertilizers necessary for agricultural activity.

Phosboukraa Integrated Chemical Complex

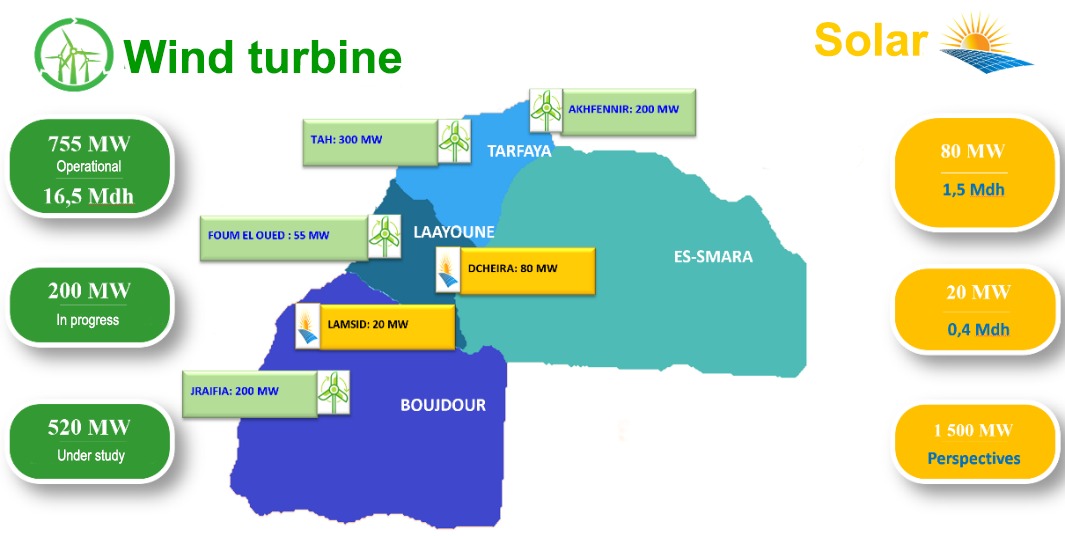

Significant potential in renewable energies

The potential for green energies (solar and wind) is significant due to the strong sunlight and the presence of significant wind corridors throughout the year.

This potential has resulted in the implementation of several large wind and solar projects, with an installed capacity of 1 GW, giving the region the position of national and African leader in the field and helping to strengthen the attractiveness of industrial activity, due to the competitiveness associated with the cost of energy and the decarbonization of industries.

Diverse and Modern Land Offer

The region offers a diversified and competitive land offer intended to welcome private investments in harmony with the territory’s vocation. The vast majority of this land base belongs to the state’s private domain. In addition, the industrial, logistical, and economic activity zones reserved for future projects are as follows:

Province: LAAYOUNE

Launched: 2019

Area(ha): 75

Average Cost:-

Province: BOUJDOUR

Launched: 2023

Area (ha): 2.20

Average cost: 550 dirhams/m2